How To Calculate Your Net Worth: A Simple Guide To Financial Clarity Today

Figuring out your financial standing can feel like a big puzzle, can't it? But really, knowing your net worth is a key step in understanding where you are financially. It's like taking a snapshot of your money picture at one specific moment. This number helps you see your progress, set new money goals, and make smarter choices for the future. You know, it really matters for your peace of mind.

Lots of folks wonder about their net worth, or maybe they just want to get a better handle on their money. It's a common question, and a good one to ask yourself, especially with everything going on in the world. People often search for "how to calculate my net worth" because they want clear, simple steps to follow. This guide is here to help you do just that, giving you a clear path.

You might think it's all about complicated numbers, but it's actually pretty straightforward. We're going to break down what net worth means and show you exactly how to find your own number. It’s a bit like using a very good calculator to get precise answers, making things simple and quick. So, let's get into the details and see what your financial picture looks like right now.

Table of Contents

- What Exactly Is Net Worth?

- Why Figuring Out Your Net Worth Matters

- Steps to Calculate Your Net Worth

- Making Sense of Your Net Worth Number

- Common Questions About Net Worth

- Keeping Track of Your Net Worth

- Start Your Financial Journey Today

What Exactly Is Net Worth?

Your net worth is a simple number. It shows what you own minus what you owe. Think of it like a balance sheet for your personal finances. It's a snapshot, a very quick look at your money situation on a specific day. You know, it tells a pretty clear story.

This number can be positive, which means you own more than you owe. It can also be negative, meaning your debts are more than your assets. Either way, it's just a starting point. It's not a judgment, just a fact. People often find this number really helpful for setting future plans.

Assets: Your Financial Plus Points

Assets are things you own that have some value. These are the "plus points" in your net worth calculation. They can be things you can easily turn into cash, or things that take a little longer. So, it's pretty important to list them all.

Some common assets include cash in your checking or savings accounts. Your investments, like stocks, bonds, or mutual funds, count too. Retirement accounts, such as a 401(k) or IRA, are definitely assets. You know, even things like a car or your home are assets, though their value can change. Any valuable possessions, like jewelry or art, also add to your assets. It's almost like a collection of all your valuable things.

Liabilities: Your Financial Minus Points

Liabilities are the money you owe to others. These are the "minus points" in your net worth calculation. They represent your debts. It's a bit like the opposite of your assets, really.

Common liabilities include credit card balances. Student loans are a big one for many people. Mortgages on your home are also liabilities. Car loans, personal loans, and any other money you borrowed count here. You know, even small things like medical bills can be liabilities until they are paid. It's basically any money that you still need to pay back.

Why Figuring Out Your Net Worth Matters

Knowing your net worth is a bit like having a map for your money journey. It helps you see where you stand right now. This number can show you if you're moving forward or if you need to make some changes. It’s a very practical tool for managing your money.

It helps you set clear money goals. Maybe you want to save for a house, or perhaps pay off some debt. Seeing your net worth change over time can keep you motivated. It’s also useful for big life decisions, like buying a home or planning for retirement. You know, it gives you a real sense of control. This kind of information is really powerful, just like using a scientific calculator to get precise measurements.

Steps to Calculate Your Net Worth

Calculating your net worth is a three-step process. It's not hard, just takes a little bit of gathering information. You can do this with a pen and paper, or even a simple online calculator. That is that, a tool that helps you do math quickly. It’s very helpful.

Step 1: Gather Your Asset Information

First, you need to list everything you own that has value. Get statements for all your bank accounts. This includes checking, savings, and any money market accounts. You know, these are usually pretty easy to find.

Next, get statements for your investment accounts. This means your brokerage accounts, retirement accounts like 401(k)s, IRAs, and any other investment vehicles. For real estate, estimate your home's current market value. You can look at recent sales in your area. For cars, check online valuation tools. Make sure to include any other valuable items, like collectibles or jewelry. It’s almost like making an inventory of your possessions.

Step 2: List All Your Liabilities

Now, list all the money you owe. Get statements for all your credit cards. Write down the total balance for each one. You know, it's good to be honest here.

Then, list all your loans. This includes your mortgage balance, car loans, student loans, and any personal loans. Don't forget any other debts, like medical bills or money owed to friends or family. This step is about getting a full picture of what you still need to pay back. It’s very important to be thorough here.

Step 3: Do the Math

This is the easy part, especially with a good calculator. Add up the total value of all your assets. This gives you your total assets number. You know, this is where a calculator can really shine, whether it's a basic one or one with advanced features.

Then, add up the total amount of all your liabilities. This gives you your total liabilities number. Finally, subtract your total liabilities from your total assets. The number you get is your net worth. So, the formula is simple: Assets - Liabilities = Net Worth. You know, it's just like using a free simple calculator for adding and subtracting.

For example, if you have $100,000 in assets and $50,000 in liabilities, your net worth is $50,000. If you have $100,000 in assets and $120,000 in liabilities, your net worth is -$20,000. It's pretty straightforward math, really.

Making Sense of Your Net Worth Number

Once you have your net worth number, what does it tell you? A positive net worth means you have more assets than debts. This is generally a good sign. It shows you're building wealth. You know, it's a number that tends to grow over time if you manage your money well.

A negative net worth means your debts are greater than your assets. This is common for younger people or those with significant student loans or mortgages. It doesn't mean you're in trouble, just that you have work to do. It's a starting point, a bit like a baseline. The goal is usually to make that number grow over time. So, don't get discouraged if it's not where you want it to be right away.

Common Questions About Net Worth

What is a good net worth by age?

There isn't one "good" net worth number for every age. It really varies a lot based on income, where you live, and your life choices. Generally, net worth tends to grow as people get older, pay off debts, and save more. It's more about your personal progress than comparing yourself to others. You know, everyone's path is different.

Is net worth calculated before or after taxes?

Net worth is typically calculated using the current market value of your assets and the outstanding balance of your liabilities. This means it's generally "before" considering future taxes on things like investment gains or retirement withdrawals. You know, it's a snapshot of today's value, not future tax implications. Tax planning is a separate, important step.

Does net worth include debt?

Yes, absolutely! Debt is a major part of your net worth calculation. All your outstanding loans and balances are your liabilities. You subtract these from your assets to get your net worth. It's the "minus" side of the equation. So, it's very much included.

Keeping Track of Your Net Worth

Calculating your net worth once is a great start. But doing it regularly is even better. Many people check it once a year, or perhaps every six months. This helps you see trends. You know, it's a way to track your financial health over time.

You can use a simple spreadsheet or even a notebook. There are also many online tools and apps that can help automate this. The important thing is to be consistent. Seeing your net worth grow can be really motivating. It's a bit like tracking your progress in a game, perhaps like a darts game where you track your scores. Learn more about simple online calculators on our site, which can help with these numbers.

If you see your net worth going down, it's a signal to look at your spending or debt. If it's going up, you're doing something right! This regular check-in helps you stay on top of your money. You know, it's a good habit to build. For more help with numbers, you might find this resource on net worth helpful too.

Remember, it's not just about the number itself. It's about what that number means for your financial journey. It's about making informed choices. So, keep at it, and watch your financial picture get clearer. You know, it’s a journey worth taking.

Start Your Financial Journey Today

Calculating your net worth is a very powerful first step toward better money management. It gives you clarity. It helps you set goals. It shows you your progress. You know, it’s a foundational piece of personal finance. It's a bit like using a calculator to ensure you always get the right answer for your math problems.

Don't wait. Gather your numbers today and find out your net worth. This simple calculation can truly change how you view your money. It empowers you to make smarter choices for your future. You know, it’s really about taking control. We have other tools, like a free online scientific calculator that can help with all sorts of calculations, too. It's almost like having a financial assistant at your fingertips. You can do this!

How to calculate your net worth – Personal Finance Club

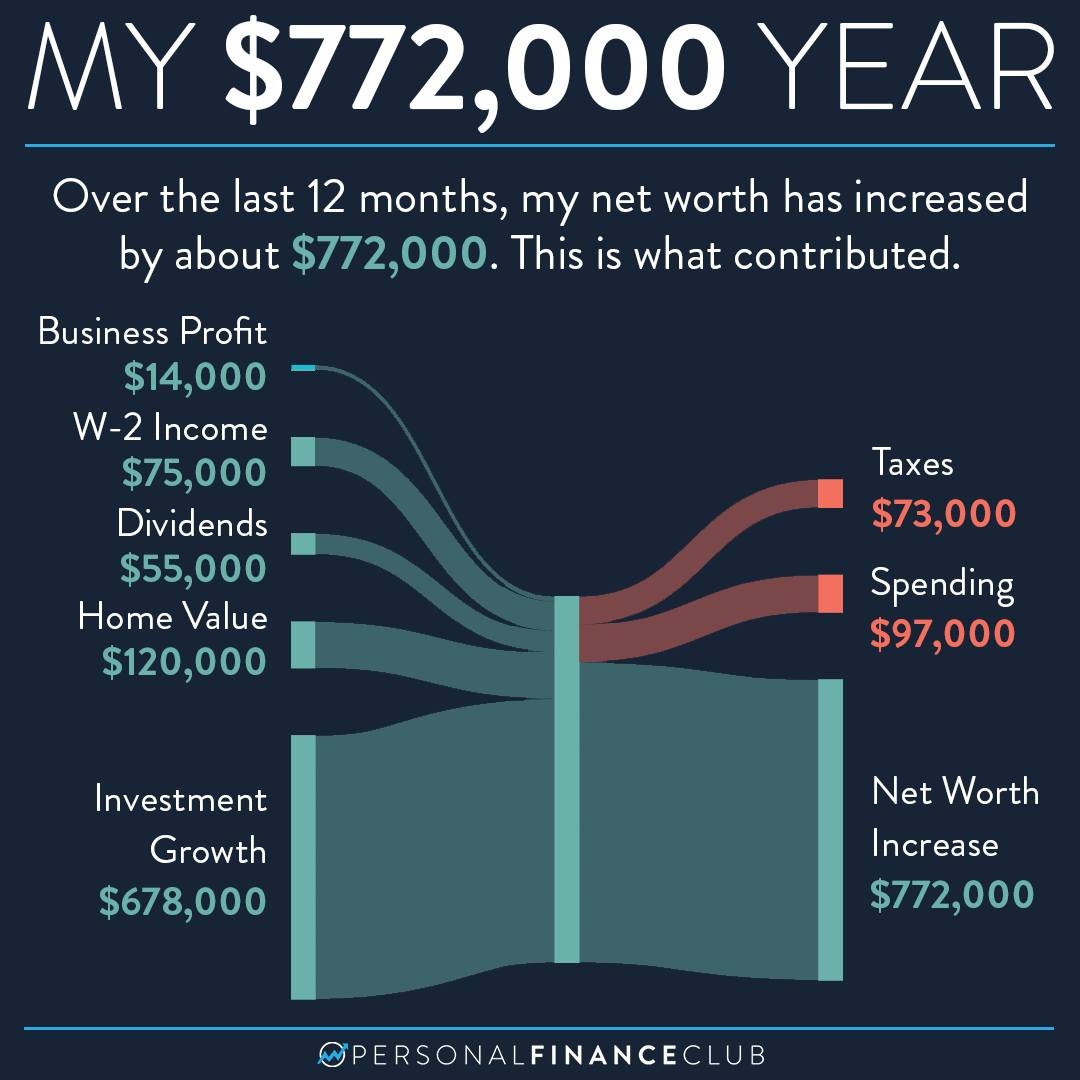

How my net worth increased by $772K over the past year – Personal

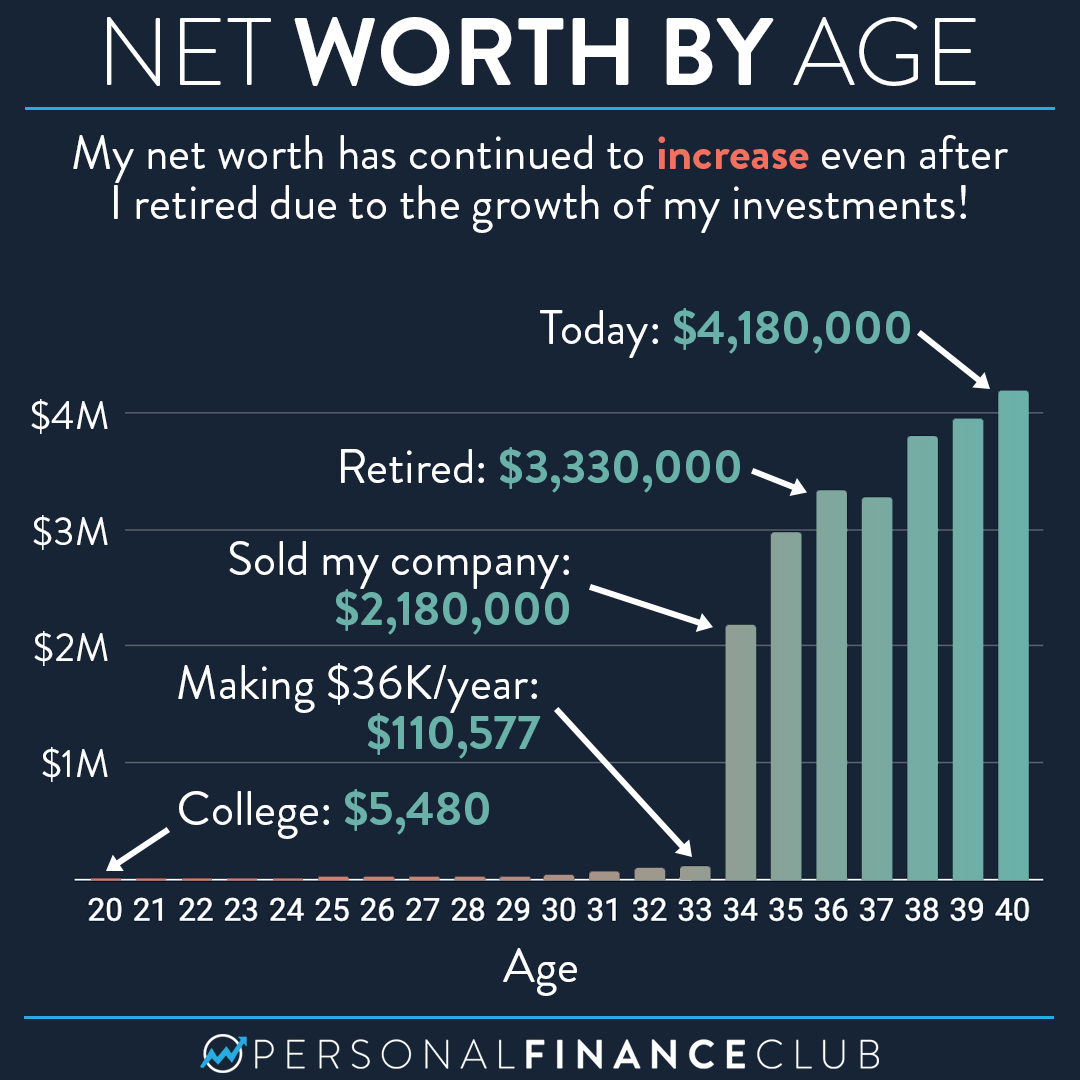

Here’s how my net worth has changed in the last 20 years – Personal