Understanding The Top 10 Percent Net Worth By Age: What It Really Means

Have you ever wondered what it truly takes to be among the financially top earners in your age group? It's a question many of us, perhaps, ponder from time to time, just a little bit. Looking at the top 10 percent net worth by age can give you, like your friends, a glimpse into where some people stand financially. It's not about comparing yourself negatively, but rather understanding financial benchmarks and what wealth accumulation might look like for others.

For many, thinking about net worth can feel a bit overwhelming, you know, especially when you consider all the different numbers out there. Net worth, simply put, is what you own minus what you owe. So, it's almost your total financial picture, covering everything from savings and investments to real estate, less any debts you might have, like mortgages or student loans. Knowing what the top 10 percent net worth by age looks like offers a sort of financial compass, helping you see what might be possible, or what some folks have already achieved.

This article aims to shed some light on the top 10 percent net worth by age, giving you some general ideas and practical thoughts on how wealth builds over time. We'll look at what factors typically play a role, and offer some general suggestions for financial growth. So, in a way, we'll explore the journey many people take to grow their finances, and what that might mean for you, too, as a matter of fact.

Table of Contents

- What Is Net Worth, Anyway?

- Why Talk About the Top 10 Percent Net Worth by Age?

- Illustrative Net Worth Numbers for the Top 10 Percent by Age

- Key Ingredients for Building Significant Net Worth

- Practical Thoughts for Boosting Your Net Worth

- Frequently Asked Questions About Net Worth

- Final Thoughts on Your Financial Path

What Is Net Worth, Anyway?

Net worth, you know, is a pretty straightforward idea once you break it down. It’s simply the total value of everything you own, like your assets, minus everything you owe, which are your liabilities. Assets can be things such as money in your bank accounts, investments in stocks or retirement funds, the value of your home, or even cars. Liabilities, on the other hand, include things like credit card balances, student loans, car loans, and your mortgage, so.

Calculating your net worth gives you a snapshot of your financial health at a specific moment. It’s a bit like taking a picture of your money situation, really. This number can change a lot over time, depending on your income, how much you save, your spending habits, and how your investments perform, you see. It’s a very dynamic figure.

Understanding this basic calculation is pretty important for anyone looking to manage their money better. It helps you see where you stand, and gives you a clear idea of how much financial ground you might want to gain, or keep, over the years. Plus, it’s a good way to track your progress as you work towards your money goals, too it's almost.

Why Talk About the Top 10 Percent Net Worth by Age?

Talking about the top 10 percent net worth by age isn't about making anyone feel bad or creating a sense of competition, not at all. Instead, it offers a helpful benchmark, a kind of reference point, you know. It lets us see what a higher level of financial accumulation might look like at different stages of life, basically. This can be pretty motivating for some people, or at least offer some general insights.

For many, it’s about setting goals that feel achievable, or understanding the financial landscape a bit better. Knowing what some people have managed to build can inspire others to think differently about their own saving and spending habits, or how they manage their money, apparently. It helps put things in perspective, like your own financial journey.

Moreover, it highlights the various paths people take to build wealth. It shows that consistent effort, thoughtful choices, and a bit of luck can really add up over time. So, it's more about learning from general patterns than striving for an exact number, you know, or comparing yourself unfairly, really.

Illustrative Net Worth Numbers for the Top 10 Percent by Age

When we look at net worth numbers for the top 10 percent, it's important to remember these are general illustrations, not hard and fast rules. Financial situations vary greatly depending on where you live, your career, life events, and the economy, you know. These figures are based on broad trends and give you a sense of what wealth might look like for some people in these age brackets, as a matter of fact. They are not precise, current statistics, but rather serve as a kind of guidepost.

Your 20s: The Foundation Years

For those in their 20s, being in the top 10 percent often means having managed to keep student loan debt low, or even paid some of it off, which is a big deal. It also often means starting to save early, perhaps in a retirement account or a general savings fund, just a little. The numbers here might not seem huge compared to older groups, but it's about setting up good habits, you see.

An illustrative net worth for the top 10 percent in their late 20s could be somewhere in the range of $150,000 to $300,000 or more. This might include early investments, some savings, and perhaps a small amount of home equity if they've bought property. It's really about having a positive net worth and starting to build a financial base, so.

Your 30s: Building Momentum

As people move into their 30s, careers often start to pick up, and incomes might rise. This decade is usually a time for significant growth in net worth for many, especially those who continue to save and invest consistently, as I was saying. Homeownership can also become a bigger factor here, adding to assets, you know.

For the top 10 percent in their 30s, an illustrative net worth could range from around $400,000 to $800,000 or even more. This typically reflects continued contributions to retirement accounts, growing investment portfolios, and increasing home equity. It's a period where financial plans often start to really take shape, and things start to feel more solid, apparently.

Your 40s: Peak Earning and Growth

The 40s are often considered peak earning years for many professionals, you know. With more established careers, there's a greater capacity to save and invest larger amounts of money. This decade can see some of the most substantial jumps in net worth for those who are financially focused, naturally.

An illustrative net worth for the top 10 percent in their 40s might be in the ballpark of $900,000 to $1,500,000 or more. This often includes a well-funded retirement plan, diversified investments, and considerable equity in a home, or perhaps multiple properties. It's a time when wealth building really accelerates, and you can see the results of earlier efforts, you know, pretty clearly.

Your 50s: Getting Ready for Retirement

In their 50s, many people are really focusing on building up their retirement nest egg, trying to maximize contributions as much as they can. For the top 10 percent, this often means having a significant portion of their wealth in retirement accounts, growing steadily. They might also be paying down mortgages, which boosts their net worth, of course.

An illustrative net worth for the top 10 percent in their 50s could be around $1,600,000 to $2,500,000 or more. At this stage, investments have had a good long time to grow, and many major debts might be close to being paid off. It's a period of consolidation and preparing for the next chapter, which is retirement, in a way.

Your 60s and Beyond: Enjoying the Fruits

For those in their 60s and beyond, net worth often reflects a lifetime of saving, investing, and managing finances. While some might start drawing down on assets for retirement living, others continue to see growth, especially if they have diverse income streams or well-managed portfolios, you know. This stage is about financial security and sometimes, leaving a legacy, too it's almost.

An illustrative net worth for the top 10 percent in their 60s and older could easily exceed $2,500,000, perhaps reaching $4,000,000 or more. This often includes substantial retirement savings, paid-off homes, and other investments that provide income. It’s a time to enjoy the financial freedom that years of planning have created, basically.

Key Ingredients for Building Significant Net Worth

Building significant net worth, enough to be in the top 10 percent, involves more than just one magic trick; it's a combination of several key elements working together, you know. It's a bit like baking a cake – you need all the right ingredients and steps. Here are some common factors that often play a big role, pretty much.

Earning Potential

Your ability to earn money, obviously, is a fundamental piece of the puzzle. Higher incomes generally allow for more saving and investing. This doesn't always mean having a fancy job; it could also mean having multiple income streams, or being very good at what you do, you see. Continuously developing skills and seeking opportunities for career growth can really boost your earning capacity over time, for instance.

Smart Saving Habits

It's not just about how much you earn, but how much you keep. Consistently saving a portion of your income, no matter how small to start, is incredibly important. This includes setting up automatic transfers to savings accounts or investment vehicles. The earlier you start saving, the more time your money has to grow, you know, which is a big plus.

Thoughtful Investing

Simply saving money isn't always enough to get into the top tiers of net worth. Investing your savings wisely is where true wealth building often happens. This means putting your money into assets that have the potential to grow over time, like stocks, bonds, or real estate. Learning about different investment options and diversifying your portfolio can really help your money work for you, as a matter of fact.

Debt Management

Managing debt effectively is another critical part of growing your net worth. High-interest debt, like credit card balances, can eat away at your financial progress. Paying down these debts quickly frees up more money for saving and investing. Smart debt management means using debt wisely, perhaps for things like a home or education, but avoiding excessive or costly borrowing, really.

Real Estate and Assets

For many, owning a home or other real estate becomes a significant part of their net worth. As property values go up and you pay down your mortgage, the equity in your home grows, adding to your assets. Other valuable assets, like a business or valuable collections, can also contribute to your overall financial picture, too it's almost. It's about accumulating things that hold or gain value, basically.

Practical Thoughts for Boosting Your Net Worth

Boosting your net worth, you know, isn't always about making huge, drastic changes overnight. Often, it's about making consistent, smart choices over a long period. Here are some practical thoughts that might help you on your financial journey, and stuff.

One good step is to truly understand where your money goes each month. Creating a budget, even a simple one, can show you areas where you might be able to save more. It’s like mapping out your spending habits, you see. Once you know this, you can make informed decisions about cutting back or reallocating funds, perhaps to savings or debt repayment, of course.

Another thing to consider is increasing your income. This could mean asking for a raise, picking up a side gig, or learning new skills that make you more valuable in your current role or a new one. Even a small increase in income, when saved or invested consistently, can make a pretty big difference over time, you know.

Automating your savings is a powerful tool, too. Set up automatic transfers from your checking account to your savings or investment accounts right after you get paid. This way, you pay yourself first, and you’re less likely to spend that money. It takes the decision-making out of it, which can be very helpful, really.

Think about investing early and regularly. Even small amounts invested consistently can grow significantly thanks to compound interest. This means your money earns money, and then that money also earns money. It's a powerful concept, and the sooner you start, the more time it has to work for you, basically. You can learn more about investing strategies on our site, and explore different options.

Finally, keep an eye on your debts, especially those with high interest rates. Paying these down quickly can free up a lot of cash flow that you can then put towards building your net worth. It’s like removing a heavy weight that’s holding you back financially, you know. For more detailed advice, you might want to check out this page on debt management.

Frequently Asked Questions About Net Worth

People often have similar questions when they start thinking about net worth and financial standing. Here are a few common ones, with some general answers, obviously.

What is a good net worth for a 30-year-old?

For a 30-year-old, a "good" net worth really varies a lot depending on their individual circumstances, like student loan debt or early career choices. However, for someone aiming for the top 10 percent, an illustrative net worth could be in the range of $400,000 to $800,000, as discussed earlier. This usually means they've started saving early, maybe bought a home, and have managed their debts well, you know.

How much money do you need to be in the top 10%?

The exact amount of money needed to be in the top 10% changes every year and depends on age. Generally, it's not just about liquid cash, but the total value of all assets minus liabilities. For younger age groups, the number is lower, growing significantly as people get older and accumulate more. For example, a 50-year-old in the top 10% would likely have a net worth well over $1.5 million, perhaps even reaching $2.5 million or more, as a matter of fact.

What are the key factors that help people build significant net worth?

Building significant net worth often comes down to a few core factors. These usually include a good earning capacity, consistent saving habits, thoughtful investing over the long term, and smart management of any debts. Having a clear financial plan and sticking to it, even through ups and downs, is also very important, really. It's a combination of these things working together, basically.

Final Thoughts on Your Financial Path

Thinking about the top 10 percent net worth by age can be a helpful way to gauge financial progress and set some personal goals, but it’s not the only measure of success, obviously. Your financial journey is uniquely yours, shaped by your own circumstances, choices, and aspirations, you know. What truly matters is building a financial life that supports your own dreams and provides you with a sense of security and freedom, too it's almost.

The path to building wealth often involves continuous learning, making informed decisions, and staying patient. It’s about understanding your money, making it work for you, and adapting your strategies as life changes. Remember, every little bit of thoughtful saving and investing adds up over time, pretty much. It's a marathon, not a sprint, you see, and every step forward counts, apparently.

For more detailed insights into wealth trends and consumer finances, you might find information from sources like the Federal Reserve's Survey of Consumer Finances very interesting. These kinds of resources can offer a deeper look into how wealth is distributed and what different financial benchmarks mean across various demographics. It’s always good to stay informed, and stuff.

Top cropped cut out | Tops y Bodies Mujer | INSIDE

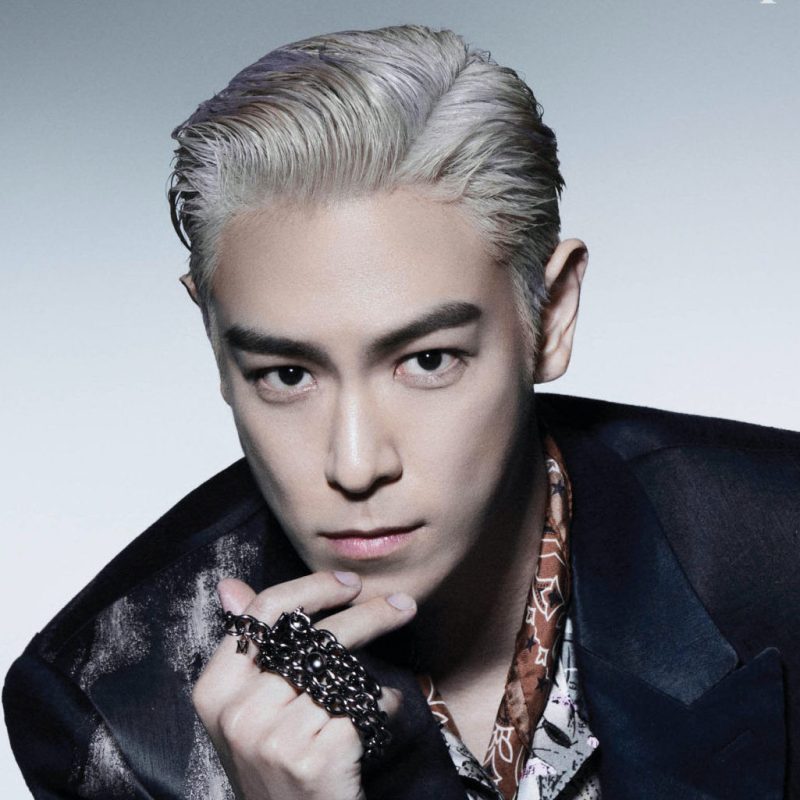

T.O.P (ex BIGBANG) Profile (Updated!) - Kpop Profiles

Tops