Check Your Net Worth - Your Financial Picture

Figuring out where you stand financially can feel like a big deal, yet it's something many people put off. It's really about getting a clear look at your money situation right now, a bit like doing a quick check-up on your overall health. Knowing this figure gives you a solid starting point for making smart choices about your money going forward, helping you feel more in control of your financial path.

This process, you know, it's pretty much like running a system scan on your computer or, say, making sure your laptop battery is working as it should. Just as you'd want to know if your PC is running slow or if your spellcheck isn't quite doing its job, you probably want to see how your personal finances are holding up. It’s a way to spot any areas that might need a little extra attention or a bit of a tune-up.

So, what exactly does "checking your net worth" mean for you? Well, it's essentially a snapshot of everything you own compared to everything you owe. Think of it as a personal balance sheet, giving you a very real number that shows your financial standing at a particular moment. It’s a simple calculation, yet it offers a powerful insight into your money world, helping you see the bigger picture.

Table of Contents

- What is a personal net worth check?

- Why does checking your net worth matter?

- Gathering Your Financial Information

- How to perform a check your net worth calculation?

- Tools to Help You Check Your Net Worth

- What if your check your net worth figure is low?

- Regular Check-ins for Your Financial Health

- Beyond the Numbers- What to do after you check your net worth.

What is a personal net worth check?

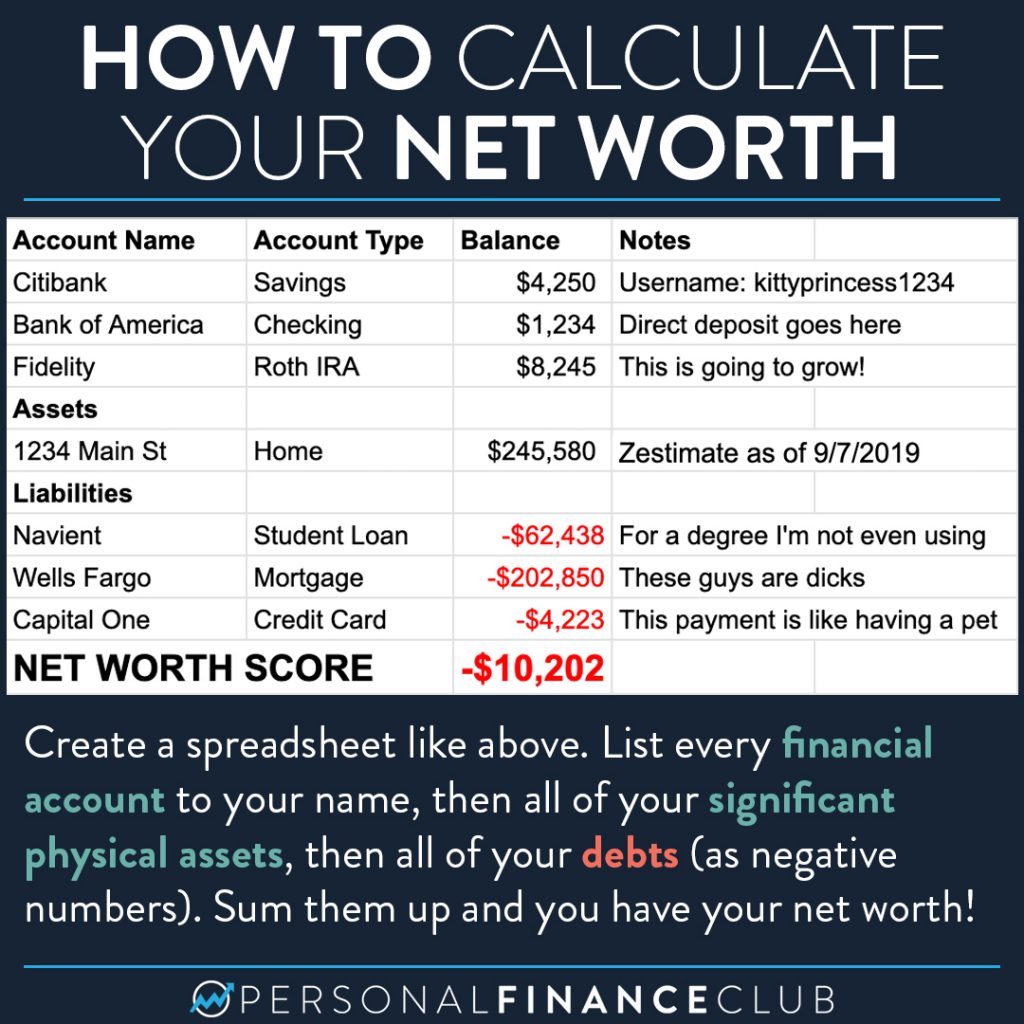

A personal net worth check, quite simply, is a way of adding up all your possessions that have value and then subtracting all your debts. The result is that single number, your net worth. It’s a pretty straightforward idea, yet it provides a deep look into your money situation. You might own a home, have money in a savings account, or possess investments; these are your valuables. On the flip side, you might have a home loan, credit card bills, or student debts; these are your obligations. The difference between these two totals gives you your financial standing.

This kind of review, you know, is a lot like doing a system check on your personal computer. When you run a PC health check, you're looking to see how everything is performing, right? Are things running smoothly, or is something slowing things down? Similarly, when you check your financial standing, you are looking at the overall health of your money. It helps you see what's working well and what areas might need a bit of fine-tuning, just like making sure your microphone and camera work before a meeting.

Why does checking your net worth matter?

Knowing this number, honestly, offers a lot of clarity. It helps you see where you stand right now, which is a key piece of information for any financial decision you might make later. Without this basic information, it’s a bit like trying to fix a spellcheck issue without knowing if the program itself is installed or if the editor option is even there. You need to know the starting point to figure out the next steps.

It also, you know, helps you set goals that make sense. If you are looking to save for a big purchase, like a house or an early retirement, seeing your current financial position gives you a real benchmark. It’s a bit like checking your Microsoft 365 subscription license to see what features you have access to. You know what you're working with, and that makes it much easier to plan for what you want to achieve next. This kind of regular review gives you a sense of direction and helps you measure your progress over time, which is very helpful.

Gathering Your Financial Information

To get a good sense of your net worth, the first thing you need to do is pull together all your financial documents. This means making a list of everything you own that has value. Think about your cash in the bank, any investment accounts, retirement savings like a 401k, and even the value of your home or other properties. These are your valuables, and compiling them is the first step. It's like gathering all the details about your Microsoft account or checking what Microsoft products you already have, before you try to install something new.

Then, you need to list all your obligations. This includes things like your home loan, student debts, car loans, and any outstanding credit card amounts. Every penny you owe needs to be on this list. It’s pretty much like how you would list any system issues you're having, such as a slow computer or commands that do not work in the command prompt. Getting a full picture of both your valuable items and your obligations is what really sets you up for an accurate calculation. This comprehensive list helps you see the complete picture of your financial standing.

How to perform a check your net worth calculation?

Once you have all your numbers laid out, the actual calculation for a check your net worth is quite simple. You take the total amount of all your valuable items and subtract the total amount of all your obligations. The number that remains is your net worth. For example, if your valuable items add up to, say, $300,000 and your obligations total $100,000, then your net worth would be $200,000. It’s a very straightforward bit of arithmetic, but it gives you a powerful summary of your financial position.

This process is, in a way, like performing a quick test on your laptop's battery capacity. You're looking at the full capacity and then seeing what's currently available, right? It's a direct comparison that shows you the real situation. Similarly, this calculation gives you a direct and clear view of your financial health. It’s not about guesswork; it’s about using concrete numbers to get a precise picture of where you stand financially, which is very helpful for future planning.

Tools to Help You Check Your Net Worth

There are quite a few different ways you can keep track of your money and figure out your net worth. Some people prefer using a simple spreadsheet, like a basic table where they can list all their valuable items and obligations and then do the math. This method is free and gives you complete control over your figures. It's a bit like using a basic text editor to write something down; it gets the job done without needing anything fancy.

Other people might choose to use financial apps or online tools. These programs often connect directly to your bank accounts and investment accounts, automatically pulling in your information. They can then calculate your net worth for you, updating it regularly. This is somewhat similar to how Microsoft Edge on Windows 10 & 11, Microsoft Authenticator, and Microsoft Wallet work together to manage your passwords and financial details. These tools make the process much smoother and less hands-on, providing a more automated way to keep tabs on your financial situation.

What if your check your net worth figure is low?

Finding out your net worth is a starting point, not a final judgment. If the number is lower than you hoped, or even if it's a negative figure, that's okay. It simply shows you where you are right now, and it gives you a clear target to work from. Think of it like when your computer is going pretty slow after a PC health check recommended it. That check doesn't mean your computer is broken forever; it just points out areas that need some attention, perhaps a clean-up or an update.

A low net worth figure, you know, just means there's room for progress. It’s a signal to perhaps look at reducing some of your obligations or finding ways to increase your valuable items. It’s an opportunity to create a plan for improvement, much like addressing those tech issues to get your system running better. This information is meant to empower you, giving you the knowledge you need to start making positive changes to your financial life, which is really what matters.

Regular Check-ins for Your Financial Health

Just like you would regularly monitor how your laptop battery is running to ensure it doesn't suddenly die on you, it's a good idea to check your financial standing on a regular basis. This isn't something you do once and then forget about. Your financial situation changes over time, as you earn more, spend differently, or pay off debts. So, reviewing your net worth every few months or once a year can give you a consistent picture of your progress.

Many people find that doing this review, say, quarterly or at least once a year, works pretty well. It allows enough time for changes to happen in your financial life, but it’s not so frequent that it becomes a chore. This consistent checking helps you stay aware of your money movements and makes it easier to spot trends or areas that might need adjusting. It’s a very practical habit to pick up for anyone looking to manage their money better.

Beyond the Numbers- What to do after you check your net worth.

Once you have that number, the real work, in a way, begins. It’s not just about getting the figure; it’s about what you decide to do with that information. If your obligations are high, you might focus on paying down high-interest debts first. If your valuable items are low, you might look into ways to save more or invest some money. It’s about taking action based on what your financial snapshot tells you, which is very important.

This is a bit like when you test your microphone and camera in Teams before a meeting. You don't just test them and then forget about it; you test them to make sure they work, and if they don't, you figure out how to fix them. Similarly, after you check your financial standing, you use that information to make adjustments. Maybe you decide to create a budget, increase your savings contributions, or explore new ways to earn money. It’s all about using the information to build a stronger financial future for yourself, and that's a very good thing.

/what-is-your-net-worth-be7a33afb9da4529abd5e376b5d325c2-f0ca49fbebe14c65a0214ae612dee924.png)

How To Calculate Your Net Worth

How To Determine Net Worth Worksheet

Calculating Your Net Worth Worksheet