APR Madrid - Your Yearly Borrowing Cost Explained

When you think about getting money for something big, like a new home or a car, or even just using a credit card for everyday things, there is a cost involved with that money. This cost, so to speak, is something we call the annual percentage rate, often shortened to APR. It is, in a way, the yearly price tag on the money you borrow, or conversely, the yearly amount you could earn if you are lending money out.

This idea of APR, you know, it is a rather central piece of information for anyone looking to get a loan or use credit. It gives you a pretty clear picture of what you will be paying over a year for the privilege of using someone else's funds. Conversely, if you are someone putting money into an investment that pays you back, this rate shows what you might get in return each year. It is a way, actually, of standardizing how we talk about the expense or income tied to money over a twelve-month period.

Figuring out what APR stands for and how it works can make a real difference in your pocketbook. It helps you make sensible choices about where you get your credit from and how you manage your financial commitments. Understanding this number, therefore, gives you a clearer view of the actual expense associated with different money options, allowing you to pick what feels right for your own situation.

Table of Contents

- What is APR and How Does it Show Up?

- What Does APR Mean for You in Madrid?

- APR and Your Credit Cards – What to Know in Madrid

- How is APR Figured Out for Loans, Especially in Madrid?

- The Full Picture – APR Versus Simple Interest in Madrid

- Are There Different Kinds of APR You Might See in Madrid?

- What Things Influence Your Interest Rate in Madrid?

- Comparing Loans and Credit Cards with APR in Madrid

What is APR and How Does it Show Up?

The annual percentage rate, or APR, represents the yearly cost that comes with borrowing a sum of money, or the yearly gain you could see from money you put into an investment. It is expressed as a percentage, which makes it easier to compare one option against another. This figure, you see, tries to capture the whole yearly financial burden, not just the basic interest rate.

When someone speaks of APR, they are typically referring to the amount of interest that builds up over the course of a year on a specific amount of money. This can be money that a bank or a lending institution charges to people who borrow from them. It is, in a way, the price for using that money for a year. So, for example, if you borrow a certain sum, the APR tells you what percentage of that sum you will owe back just for the act of borrowing it over a twelve-month span. This is pretty much how it works, actually.

On the flip side, APR can also describe the yearly earnings that someone receives when they have put their money into an investment. For instance, if you lend money to someone or invest in a savings product, the APR might indicate the rate at which your money grows each year. This means that, in some respects, APR serves as a way to measure both the cost of taking money and the benefit of giving money, all expressed as a yearly rate. It is a very useful tool for financial planning, you know.

What Does APR Mean for You in Madrid?

For you, as someone perhaps looking at money matters in Madrid, APR is a very important piece of information to keep in mind. It is presented as a percentage that shows the total yearly expense of borrowing. This figure is not just about the basic interest rate; it also takes into account other charges that might come along with your loan or credit arrangement. It is a more complete picture, you see, of what you are truly paying over time.

When you are considering something like a credit card or a personal loan, the APR gives you a standard way to look at the cost. It helps you compare different offers side by side, making it easier to pick the one that feels like the best fit for your budget. Without this number, it would be much harder to figure out the real expense of borrowing, as different places might have different ways of calculating fees. This is why it is, in fact, so important to pay attention to it.

So, when you see an APR figure, think of it as the annual price you are paying for the privilege of using someone else's money. It is a figure that helps you get a better sense of the financial commitment involved. This way, you can make a choice that you feel good about, knowing what the yearly financial impact will be. It is, basically, a guide for your money choices.

APR and Your Credit Cards – What to Know in Madrid

When it comes to credit cards, particularly if you are thinking about them in Madrid, APR plays a very significant part in how much you end up paying. If you do not manage to pay off your entire credit card balance at the close of each month, the company that issued your card will begin to charge you interest. This interest is applied to the part of your balance that you did not pay off, the part that you carried over to the next month. It is, in short, the cost of not settling your debt in full right away.

This interest that gets charged is directly tied to the APR of your credit card. So, a higher APR means that the interest charges on your carried balance will be bigger. It is a pretty straightforward connection, really. This is why many people suggest trying to pay off your credit card bill in its entirety each month, if you can, because it means you avoid paying these extra interest charges altogether. It can save you quite a bit of money, in some respects.

Knowing your credit card's APR is a helpful piece of knowledge because it helps you understand the true expense of using your card if you carry a balance. It is not just about the things you buy; it is also about the cost of borrowing that money. This is why it is often a good idea to look for cards that offer a lower APR, especially if you think you might not always pay off your full balance. This can make a difference to your financial comfort, you know.

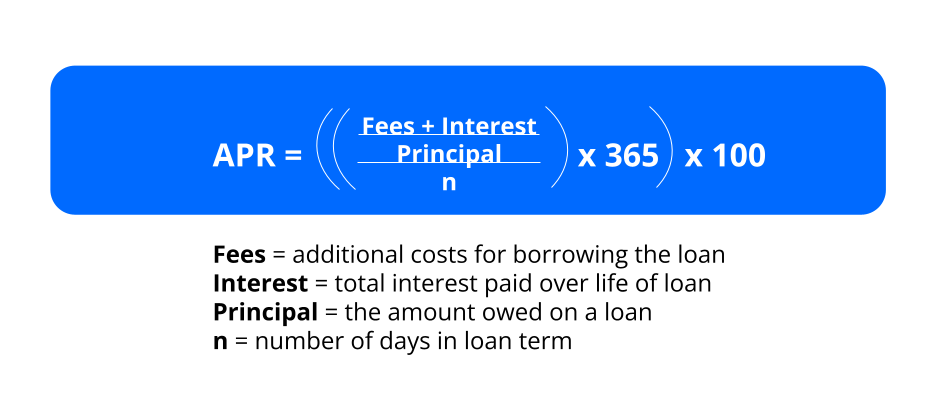

How is APR Figured Out for Loans, Especially in Madrid?

Figuring out how APR is calculated for loans, even for those you might consider in Madrid, involves more than just looking at the basic interest rate. APR is designed to give you a more complete picture of the yearly expense of a loan. It includes the interest rate itself, but also adds in any other required fees that come with getting the loan. This means that, apparently, the APR gives you a truer sense of the overall cost.

For example, when you apply for a loan, there might be certain charges like arrangement fees, processing fees, or even charges for things like credit checks. These are all expenses that are part of the borrowing process. The APR takes these extra charges and spreads them out over the yearly cost of the loan, adding them to the interest. This is how it gives you a single percentage that represents the total yearly burden. It is, in a way, a very helpful summary.

Understanding how APR is put together helps you make smart choices when borrowing money. It allows you to see past just the interest rate and look at the whole picture of what you will be paying. Knowing this helps you make informed decisions about taking on debt, ensuring you pick a loan that fits your financial situation and helps you manage your money effectively. You can, in fact, use this information to seek out better deals.

The Full Picture – APR Versus Simple Interest in Madrid

When you are comparing money options, perhaps in Madrid, you might hear about both APR and simple interest rates. It is pretty important to know that these are not the same thing. A simple interest rate just tells you the percentage of the money you are borrowing that will be charged as interest over a certain period. It is, basically, a very direct way of looking at the cost of using money.

However, the annual percentage rate (APR) gives you a much fuller picture. Unlike simple interest, APR includes not only the interest rate but also other fees that might be part of the loan or credit agreement. These could be things like charges for setting up the loan, or other administrative costs that you have to pay. So, in some respects, APR tries to show you the true yearly expense of borrowing, taking into account all the mandatory costs.

This means that while a simple interest rate might look lower, the APR could be higher because it accounts for those extra fees. This is why it is often suggested to look at the APR when you are comparing different borrowing options. It helps you see the complete yearly cost, allowing you to make a more accurate comparison between different lenders or credit products. It is, you know, a way to avoid surprises later on.

Are There Different Kinds of APR You Might See in Madrid?

Yes, there are, as a matter of fact, different kinds of APR that you might come across, even if you are looking at financial products in Madrid. While the basic idea of APR as a yearly cost remains the same, how it applies can change depending on the type of credit product. For instance, a credit card might have different APRs for purchases versus cash advances, or for introductory periods versus standard rates. It is, basically, not always a single, unchanging number.

Some APRs are fixed, meaning they stay the same for the entire life of the loan or for a set period. This can offer a sense of predictability in your payments. Others are variable, which means they can go up or down over time, often tied to a broader economic index. This means your payments could change, so it is something to be aware of. You might see these variations, you know, across different types of loans like mortgages or personal loans.

Knowing that different types of APR exist helps you ask the right questions when you are looking for credit. It helps you understand exactly what kind of rate you are getting and how it might affect your payments over time. This kind of information is pretty helpful for making choices that fit your financial situation. It is, arguably, a key part of being an informed borrower.

What Things Influence Your Interest Rate in Madrid?

When you are thinking about borrowing money, perhaps in Madrid, several things can actually influence the interest rate you are offered, which then affects your APR. One of the biggest factors is your credit standing. Lenders look at your past history of managing money, like how well you have paid bills and other debts. A good history usually means you are seen as less of a risk, and so you might get a lower interest rate.

The type of loan you are getting also plays a part. For example, a mortgage, which is secured by your home, might have a different kind of interest rate compared to an unsecured personal loan. The length of the loan can also influence the rate; sometimes, longer loan periods might come with slightly different rates than shorter ones. These are all things that lenders consider, you see, when they are figuring out what to offer you.

Also, general economic conditions can have an impact. When the economy is doing certain things, it can influence interest rates across the board. This means that the rates available today might be different from those available a few months from now. To get a lower APR, it often helps to have a good credit background and to shop around, comparing offers from various places. This is, in fact, a pretty good strategy.

Comparing Loans and Credit Cards with APR in Madrid

Using the APR is a very good way to compare different options for loans and credit cards, whether you are looking in Madrid or anywhere else. Because APR includes both the interest rate and any extra fees, it gives you a single, clear number that represents the total yearly cost of borrowing. This makes it much simpler to put different offers side by side and see which one is genuinely more affordable for you.

Many lenders, these days, will put their APRs right out in the open, often on their websites. This is done to make it easier for people like you to compare what is available before you even apply. So, instead of trying to figure out various interest rates and then adding up different fees yourself, you can just look at the APR to get a quick sense of the overall yearly expense. It is, frankly, a very convenient feature.

So, if you are thinking about getting a new credit card, or perhaps a loan for something big, always take a moment to look at the APR. It tells you the full yearly cost of using that money, including all the interest and other charges. This simple comparison tool helps you make smart choices, ensuring you pick the option that makes the most sense for your wallet and your financial comfort. It is, pretty much, your best friend when comparing credit offers.

Annual Percentage Rate (APR) — Explained, Definition and Examples

How does credit purchase work? Leia aqui: How does credit card purchase

What Is Annual Percentage Rate (APR)? | Zillow